Introduction: A Milestone Moment

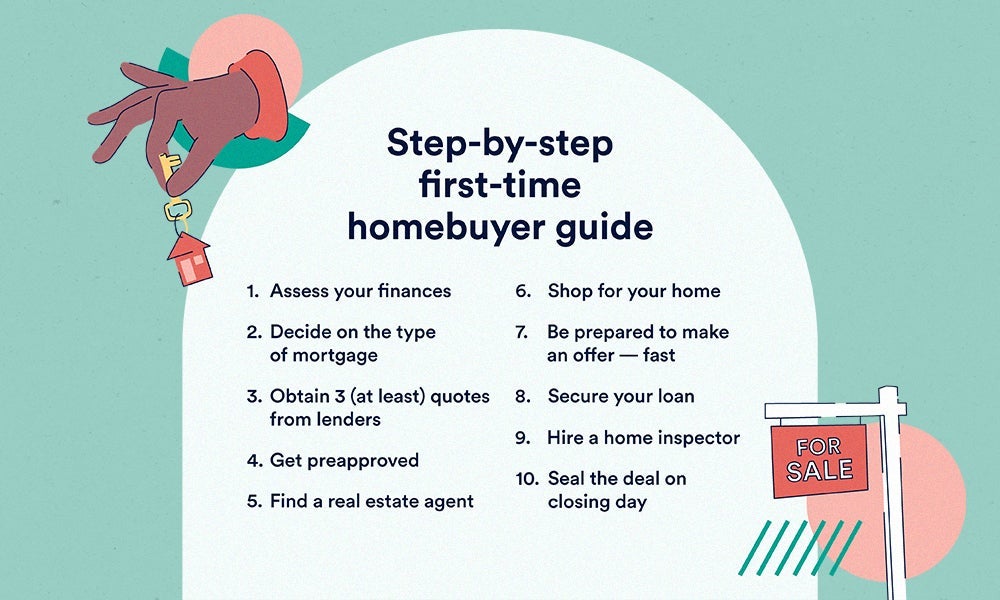

Buying your first home is an exciting and life-changing experience, but it can also be overwhelming if you’re not fully prepared. From budgeting and mortgage options to understanding what happens during closing, the homebuying process in the United States involves multiple steps, players, and decisions.

This guide aims to walk you through the essential basics of becoming a first-time homebuyer in the U.S., so you can move forward with clarity and confidence.

Owning a home isn’t just a rite of passage—it’s a major financial milestone. It allows you to:

- Build equity over time

- Stabilize your living costs

- Gain tax advantages

- Enjoy the freedom to customize your space

However, it also comes with responsibilities such as maintenance, insurance, and property taxes.

Before jumping into home tours and open houses, take a clear look at your financial situation. Here’s how:

Your credit score plays a huge role in mortgage approval and interest rates. Most conventional lenders look for a score of 620 or higher, though FHA loans accept as low as 580 with 3.5% down.

Lenders typically prefer a DTI ratio below 43%. This includes all your debts (student loans, car payments, credit cards) compared to your gross monthly income.

While 20% is ideal to avoid Private Mortgage Insurance (PMI), many first-time buyers put down much less—especially with FHA, VA, or USDA loans.

There are several loan options available for first-time buyers, each with unique requirements.

These are not backed by the government and usually require higher credit scores. If you put down less than 20%, PMI is typically required.

Backed by the Federal Housing Administration, FHA loans allow down payments as low as 3.5% and are designed for buyers with moderate credit scores.

Available to veterans and active military members, these loans require no down payment and no PMI.

For rural and some suburban areas, USDA loans offer no-down-payment financing for low-to-moderate income buyers.

Many first-time buyers underestimate the true cost of owning a home. Beyond the down payment and monthly mortgage, consider:

- Property taxes

- Homeowner’s insurance

- Maintenance and repair costs

- Homeowners Association (HOA) fees (if applicable)

- Utility bills (larger homes = higher costs)

Use a mortgage affordability calculator to determine what you can safely afford without becoming “house poor.”

Pre-approval isn’t just a formality—it tells sellers you’re serious and financially qualified. Here’s what the process involves:

- Filling out a loan application

- Providing proof of income (W-2s, pay stubs, tax returns)

- Supplying bank statements

- Undergoing a credit check

Once approved, you’ll receive a letter stating how much you’re approved to borrow—use this as your shopping guide.

A good agent is your advocate in the buying process. They can:

- Help you identify properties within your budget

- Negotiate offers on your behalf

- Guide you through contracts and contingencies

- Offer insights into neighborhood safety, schools, and resale value

Make sure your agent is familiar with first-time buyer programs in your state or county.

Once you’re pre-approved and have an agent, it’s time to shop! Keep these tips in mind:

- Make a list of non-negotiables (e.g., location, bedrooms, school districts)

- Understand the local market—prices can vary dramatically by city or even zip code

- Visit homes in person to assess condition, layout, and neighborhood

Be prepared to act quickly in competitive markets where listings sell fast.

Once you’ve found the perfect place, your agent will help you draft an offer. The offer typically includes:

- Price

- Contingencies (inspection, financing, appraisal)

- Earnest money deposit (usually 1-3% of the purchase price)

- Preferred closing timeline

The seller may accept, reject, or counter your offer.

After your offer is accepted:

A home inspection checks for defects in the property—roof damage, plumbing, HVAC issues, mold, foundation cracks, etc. You can negotiate repairs or credits based on the findings.

Required by the lender, the appraisal ensures the home is worth the price you’re paying. If the home appraises for less than the offer, you may need to renegotiate or cover the difference.

This is the underwriting stage where the lender double-checks all your documents and credit history. They’ll verify:

- Income

- Assets

- Employment

- Debt levels

You may need to provide additional paperwork. Don’t make large purchases or switch jobs during this time—it could affect your loan approval.

Closing is the final step where you legally take ownership. Here’s what to expect:

You’ll receive this 3 days before closing. It outlines your final loan terms, monthly payments, and closing costs (which can range from 2–5% of the home price).

Do a final walkthrough 24 hours before closing to ensure the property’s condition is as expected.

At closing, you’ll sign the mortgage note, deed of trust, and other documents. Bring your ID, a certified check (or wire transfer) for the down payment, and proof of homeowner’s insurance.

Once everything’s signed and the transaction is funded, you’ll receive the keys and become the legal owner.

Many federal, state, and local programs exist to assist first-time buyers. Here are a few:

- FHA First-Time Buyer Program

- Good Neighbor Next Door (GNND) – For teachers, firefighters, police, and EMTs

- HomeReady and Home Possible – Fannie Mae and Freddie Mac programs

- State Housing Finance Authorities (HFAs) – Offer grants, forgivable loans, and down payment assistance

Check HUD.gov for your state’s options.

Congratulations, you’re now a homeowner! But the journey doesn’t stop here.

Set aside money for repairs, maintenance, and unexpected costs like a leaky roof or broken furnace.

Avoid late fees by automating your payments. You may even get a small interest rate discount.

Make sure your assessed value is accurate. You can appeal if it seems too high.

Seasonal upkeep will protect your home’s value and save on costly repairs later.

Buying your first home in the U.S. can be complex, but with the right knowledge and guidance, it’s absolutely achievable. By understanding the process—from financial prep and mortgage options to final closing steps—you’ll be ready to make one of the most rewarding investments of your life.